Indicators on Kam Financial & Realty, Inc. You Should Know

Indicators on Kam Financial & Realty, Inc. You Should Know

Blog Article

Things about Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. - An OverviewKam Financial & Realty, Inc. Can Be Fun For AnyoneThe Best Guide To Kam Financial & Realty, Inc.The 4-Minute Rule for Kam Financial & Realty, Inc.The Single Strategy To Use For Kam Financial & Realty, Inc.The Basic Principles Of Kam Financial & Realty, Inc.

We might receive a cost if you click on a lending institution or submit a type on our internet site. The lending institutions whose prices and various other terms show up on this chart are ICBs advertising companions they provide their price information to our information partner RateUpdatecom Unless changed by the customer marketers are sorted by APR least expensive to highest For any kind of advertising and marketing companions that do not give their price they are provided in advertisement display systems at the bottom of the chart Advertising partners might not pay to boost the regularity top priority or prestige of their display The rate of interest rates yearly percent prices and other terms promoted here are price quotes given by those promoting companions based on the details you went into over and do not bind any loan provider Regular monthly settlement quantities mentioned do not include quantities for tax obligations and insurance premiums The real payment obligation will certainly be better if tax obligations and insurance coverage are included Although our data partner RateUpdatecom collects the information from the financial organizations themselves the accuracy of the data can not be guaranteed Rates may transform without notification and can alter intraday Some of the info consisted of in the price tables including however not restricted to special advertising notes is provided straight by the loan providers Please confirm the rates and deals prior to applying for a loan with the financial institution themselves No rate is binding until secured by a lending institution.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

The amount of equity you can access with a reverse home mortgage is determined by the age of the youngest borrower, existing rates of interest, and the value of the home in inquiry. Please note that you might need to reserve extra funds from the financing proceeds to spend for taxes and insurance.

Rates of interest might vary and the specified rate might transform or otherwise be readily available at the time of finance dedication. * The funds offered to the debtor might be restricted for the very first year after financing closing, because of HECM reverse home loan requirements ((https://profiles.delphiforums.com/n/pfx/profile.aspx?webtag=dfpprofile000&userId=1891242010). Additionally, the debtor might require to allot extra funds from the funding proceeds to pay for tax obligations and insurance coverage

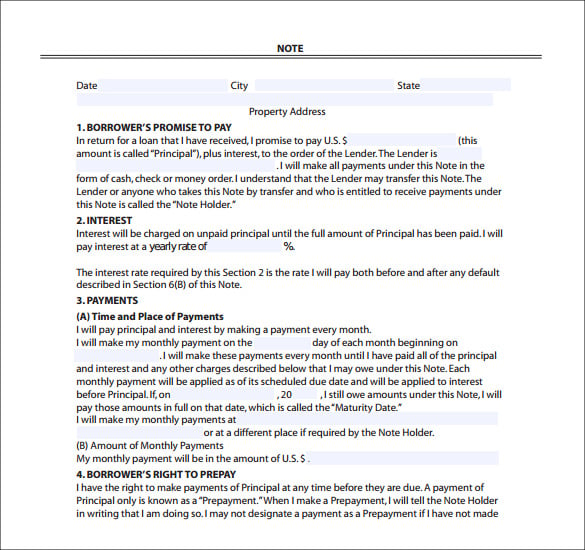

In return, the loan provider puts a genuine estate lien on the property as safety for the loan. The home mortgage transaction typically involves two main files: a promissory note and an action of trust fund.

9 Easy Facts About Kam Financial & Realty, Inc. Shown

A lien is a legal claim or passion that a loan provider has on a debtor's property as safety for a financial obligation. In the context of a mortgage, the lien created by the deed of trust enables the loan provider to acquire the building and market it if the consumer defaults on the car loan.

These mortgages include a fixed rate of interest price and regular monthly settlement quantity, supplying stability and predictability for the customer. He secures a 30-year fixed-rate mortgage with a 4% passion price.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

This suggests that for the whole three decades, John will certainly make the same month-to-month repayment, which offers him predictability and security in his economic preparation. These home mortgages begin with a set rate of interest rate and settlement amount for a preliminary duration, after which the rate of interest and repayments might be occasionally changed based on market conditions.

An Unbiased View of Kam Financial & Realty, Inc.

These home mortgages have a set rates of interest and settlement amount for the financing's duration but require the customer to settle the lending equilibrium after a specified period, as identified by the lending institution. california mortgage brokers. For instance, Tom has an interest in buying a $200,000 property. (https://papaly.com/categories/share?id=18529d7232e542f1b27d23e4be44ed9b). He chooses a 7-year balloon home mortgage with a 3.75% set rate of interest price

For the entire 7-year term, Tom's month-to-month settlements will certainly be based on this fixed rate of interest. However, after 7 years, the staying car loan balance will end up being due. At that factor, Tom must either pay off the outstanding balance in a lump amount, re-finance the loan, or market the home to cover the balloon payment.

Wrongly claiming to survive a residential or commercial property that will be made use of as a financial investment residential property in order to secure a lower interest price. Appraisal fraud entails deliberately overvaluing or underestimating a home to either get more money or secure a lower cost on a foreclosed property. Wrongly claiming self-employment or a raised position within a company to misrepresent revenue for home loan purposes.

All about Kam Financial & Realty, Inc.

Report this page